Explanation of Products

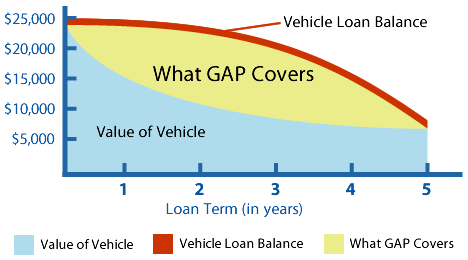

GAP pays the difference between what the customer owes to the bank and what the insurance company says the car is worth. And it often pays the customer’s deductible, or some portion of it. GAP is relatively inexpensive, and is well worth it for folks leasing a vehicle or purchasing a new vehicle.

Benefits and Features

- Payable in the event of a total loss

- GAP benefit covers up to $50,000

- Up to 84 months of protection available

- GAP is applicable for vehicles valued up to $100,000 at time of purchase!

- Minimal monthly cost to the customer

- Coverage is cancellable

- Protects clients personal credit rating

- Coverage available for most financed new and pre-owned vehicles

- GAP coverage remains intact if your primary automotive insurance coverage lapses

Limitations

Not eligible on vehicles with a salvage title, commercial vehicles, motorcycles, recreational vehicles, watercraft vehicles or vehicles weighing over 12,500 lbs.

Maximum Lease Term: 60 Months

Amount Financed/Capitalized Cost: Lesser of $100,000 or 150% MSRP (new)/ 150% NADA/Kelley Blue Book (CA Only) Retail (used)

Coverage not available in all states

GAP Statistic

- According to Automotive News, the average new car will lose 60% of its value over 3 years of normal driving.

- The Insurance Information Institute estimates that one vehicle is stolen in the United States every 24 seconds.

- CCC Information Services, a firm that supplies the automotive claims and collision repair industries with collision statistics, tells us that 18% of vehicles involved in a collision will result in a total loss.

- Insurance companies report that on an annual basis, they write off 500,000 insured vehicles due to total loss, fire or theft.

3 FACTORS IMPACTING GAP

Ongoing Economic Change

- Avg loan amount increased 4.5% YOY 2017-2018, reaching $32K new units, and topping $20K for used units. (per Experian 2018-Q4 Automotive Finance Market report)

- “Typical” loan terms are now 72-84 months (trending to 96 mos also): longer loan terms equates to slower pay down of the principal loan balance therefore the “GAP” between payoff and actual value widens.

- Vehicle prices have steadily increased each year (both new & used) while value has been diminishing more quickly year over year.

- Car owners are facing rising costs of insurance premiums due to expense of vehicles vs value loss.

- Insurance companies are steadily raising premiums to make up for deficiency balances, and also for the number of natural disasters that have impacted claims by the “billions”.

Depreciation

- New (and used) car prices continue to increase, residual values/ ACV’s are decreasing.

- Decreasing values result in deficiency balances in the total loss of a vehicle

- Decreasing values result in a “negative equity” trade situation. Rolling over negative equity from your trade to the new purchase automatically and immediately widens that GAP in value.

Lack of Consumer knowledge

- In the event a vehicle is a total loss, consumers expect it to be covered by their insurance. The insurance company will only cover the ACV (Actual Cash Value) of which is also determined “by the same insurance company”

- Purchasing GAP through the dealership provides a 3rd party not associated with your insurance premium and is neutral in determining the vehicles ACV. There role is to cover the GAP between the insurance ACV determination and the loan payoff balance.

- GAP will cover from 125% up to 150% of the vehicles value helping to reduce or eliminate a potential deficiency balance. Insurance companies will only pay what “they” deem the ACV to be

Information resource: Allied Solutions article 4/10/19